In the ever-evolving landscape of modern economics, two seemingly disparate choices often find themselves under the spotlight: the decision to live off unemployment benefits and the artful manoeuvring of tax evasion. At first glance, these choices might appear to occupy different moral landscapes, yet a closer examination reveals a surprising similarity in their ethical implications. Frequently cast in binary terms, be it virtuous or exploitative, invite a deeper exploration of societal values and individual choices.

The Unemployment Conundrum

Imagine a world where one chooses to make a career out of unemployment, opting to receive public benefits rather than contributing through traditional employment. This choice, while seemingly counterintuitive and often met with societal disdain, raises intriguing questions about societal norms and personal motivations. It is perceived as parasitic, a drain on the communal resources—a one-sided draw from the communal pot made without replenishing it. Employment, by contrast, is celebrated as the cornerstone of economic productivity and social legitimacy and contribution. The mainstream ethical argument posits that when employment opportunities exist, opting for unemployment is unethical. It is seen as a failure to contribute economically or socially, thereby lacking the discipline and work ethic society currently values.

Yet, this perspective overlooks a crucial nuance: unemployment is not always a choice. Economic downturns, personal circumstances, and systemic barriers often constrain this decision. In such cases, unemployment benefits serve as a safety net, a government-provided service fulfilling its role in supporting those in need. From a personal perspective, the allure of minimal effort for maximum gain is understandable. If one can secure financial stability with less exertion, the temptation is not only palpable but pragmatic. This perspective confronts the rote ideology surrounding work and dismantles the sanctified myths of productivity, which champion discipline and contribution as cornerstones of a respectable livelihood and pirouettes past the pieties of modern work culture.

A key nuance worth examining it is the principle of work ethic that holds value, or the act of hard work itself. If it is simply “work ethic,” as is often claimed, then virtue lies in the act of working for its own sake, regardless of outcome. This suggests a system invested in sustaining itself indefinitely — one that rewards diligence only insofar as it maintains the status quo, without any guaranteed promise of mobility or reward. If, on the other hand, it is hard work for its own sake that is valued, then the focus shifts to the exertion required to achieve results. If this were what society genuinely prized, then other forms of strategic shortcutting — like tax evasion — would elicit similar moral outrage. After all, in both cases, the allure lies in sidestepping effort while still attaining financial autonomy and liberation.

The Tax Evasion Paradox

Enter the realm of tax evasion — a practice celebrated for its cleverness and legal dexterity. Here, individuals, exploit legal loopholes to minimise their tax contributions. While technically legal, this choice mirrors the ethical quandary of unemployment: it bypasses the mechanism of contributing to the common good. By sidestepping tax obligations, individuals bypass the contribution mechanism, much like those who choose unemployment. However, tax evasion is often a choice of the affluent, not driven by necessity but by the desire to retain wealth. It is a choice generally unburdened by necessity and is instead a deliberate decision that is institutionally supported. Here, witholding from the communal pool has wider consequences, in that it undermines the government’s ability to redistribute resources and support those who cannot contribute. In this light, tax evasion not only defrauds the public but also erodes the foundational role of government by undermining the very foundation of societal support systems.

Facts & Figures

Expenditure on social protection benefits — including unemployment support — accounted for just over 25% of GDP across Europe in 2022 and 2023, according to Eurostat (2024). This represents a substantial investment by European states in maintaining safety nets for their populations, with many countries increasing this proportion by several percentage points over the same period. Such spending underscores the scale of institutional commitment to welfare provisions, especially in the aftermath of overlapping crises like the COVID-19 pandemic and the energy price shocks that followed.

Yet, while the visibility of public expenditure is high, the opacity surrounding individual tax behavior — particularly evasion — presents a stark contrast. Estimating the extent of tax evasion across EU member states remains complex, not only due to limited reporting mechanisms but also because of the layered nature of modern financial systems. The involvement of cross-border transactions, tax havens, and hybrid financial instruments blurs the lines between legal avoidance and illegal evasion.

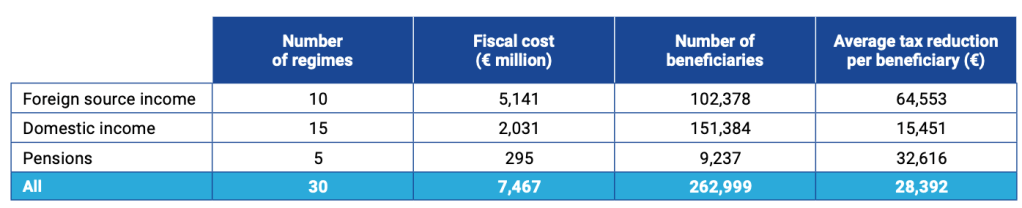

A 2024 EU-wide study (Stiglitz et al., 2024) further highlighted the extent to which everyday products and services embed opportunities for tax minimization. These include real estate investment vehicles, private pension schemes, and capital gains structures — all of which offer legal but opaque avenues to reduce tax burdens, disproportionately benefiting individuals with access to financial expertise and mobility.

Together, these dynamics paint a picture of imbalance: while states shoulder increasing fiscal responsibilities to uphold social protections, some individuals — often the most resourceful or well-positioned — can navigate around contributing proportionately to that very system. The tension between rising public spending and elusive private contribution raises deeper questions about equity, obligation, and the social contract underpinning contemporary economic life.

Rethinking Contribution

In the end, both choices reflect a broader societal challenge: how to balance individual freedom with communal responsibility. When navigating this ethical landscape, it is crucial to recognise the similarities between the two choices and question the narratives that shape our perceptions. Those who choose unemployment are often criticised for lacking discipline, while tax evaders similarly fail to exhibit the valued traits of responsibility and societal contribution. Yet, the motivations and implications of these choices differ significantly, offering a rich tapestry for analysis and revealing the often overlooked yet intricate dance between individual choices and collective well-being.

Sources

Eurostat. (2024, November 25). EU social benefits expenditure up 6% in 2023. Eurostat. https://ec.europa.eu/eurostat/web/products-eurostat-news/w/ddn-20241125-2

Stiglitz, J., Annette Alstadsæter, Sarah Godar, Panayiotis Nicolaides, Gabriel Zucman, Giulia Aliprandi, Mona Baraké, Kane Borders, Paul-Emmanuel Chouc, Souleymane Faye, Eloi Flamant, Idann Gidron, Elvin Le Pouhaër, Quentin Parrinello, Idann Gidron, Pierre Bachas, Matthew Collin, Andreas Økland, Sofía Balladares, . . . Benjamin Grillet. (2024). GLOBAL TAX EVASION REPORT 2024. In GLOBAL TAX EVASION REPORT 2024 [Report]. https://www.taxobservatory.eu/www-site/uploads/2023/10/global_tax_evasion_report_24.pdf

Leave a comment